Initiating Coverage| Consumer Durable

June 21, 2018

Amber Enterprises India Ltd

BUY

CMP

`965

A well ‘conditioned’ bet on the booming AC space

Target Price

`1272

Amber Enterprises India Ltd. (Amber) is the market leader in the room air

Investment Period

12 Months

conditioners (RAC) outsourced manufacturing space in India. It is a one-stop

solutions provider for the major brands in the RAC industry and currently serves

eight out of the ten top RAC brands in India. Its growing manufacturing

Stock Info

capabilities and scale put it in a sweet spot to capture the underpenetrated RAC

Sector

Consumer Durable

market in India.

Market leadership driven by integration and R&D: Amber commands ~19%

Market Cap (` cr)

3,035

market share in RAC manufacturing through its 12 manufacturing facilities

Beta

0.7

located across India. In a short span of nine years, it has evolved from being

52 Week High / Low

1327/964

original equipment manufacturing (OEM) to high-margin Original Design

Avg. Daily Volume

63,284

Manufacturing (ODM, forms 85% of revenue) in RAC mainly led by aggressive

Face Value (`)

10

backward integration and R&D capabilities.

BSE Sensex

35,547

Favorable industry trends: RAC industry is growing at 10%+CAGR where ODM’s

Nifty

10,772

share is expected to grow to reach 56% of the RAC market by 2022 (from current

Reuters Code

AMBE.BO

34%). These factors favor Amber owing to its focus on ODM. Further, the product

Bloomberg Code

AMBER.IN

approval cycle goes beyond 2-3 years creating a moat for Amber to keep the

competition under check. After the recent acquisitions in the Printed Circuit Board

Shareholding Pattern (%)

space, it can manufacture up to 90% of an RAC barring compressor.

Promoters

44.0

Strong boost in profits and debt reduction: The company improved its margins to

MF / Banks / Indian Fls

33.0

8.6% in FY2018 led by higher capacity utilization amid robust RACs’ demand.

Due to its recent acquisitions (~20-22% of FY2019 revenue) which have lower

FII / NRIs / OCBs

10.8

margins, overall margins may not expand in near term, but operating profits

Indian Public / Others

12.2

would see good absolute jump. Repayment of its LT debt from IPO proceeds has

substantially reduce its interest cost and will boost earnings amid limited capex

Abs.(%)

3m 1yr

3yr

requirements.

Sensex

7.2

14.5

31.1

Outlook & Valuation: We expect Amber to report consolidated revenue/PAT

Amber

(12.8)

CAGR of 28%/51% respectively over FY2018-20E. It is currently trading at 21x FY

2020 earnings which is at 25-30% discount than its closest peer - Dixon

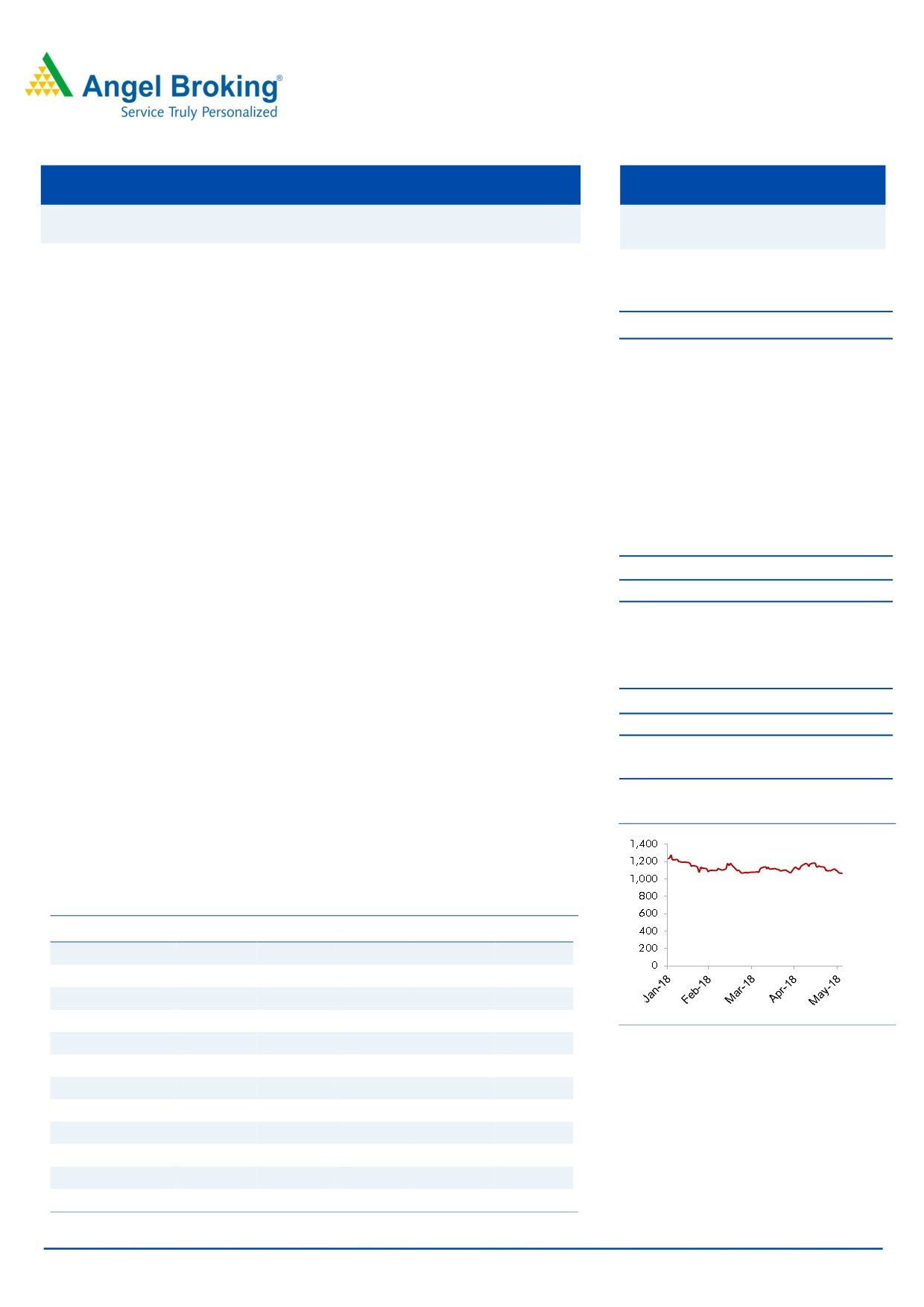

3-year price chart

Technologies. The recent correction has provided a very good entry point for the

investors to take a bet on the booming AC space. Hence, we initiate coverage on

the stock with a BUY recommendation and Target Price of `1272 (28x FY2020E

EPS), an upside of 32% from the current levels.

Key Financial

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

Net Sales

1,089.0

1,651.9

2,128.1

2,957.5

3,489.8

% chg

-11.5

51.7

28.8

39.0

18.0

Net Profit

24.1

25.2

62.3

113.0

142.9

% chg

-13.5

4.5

147.4

81.4

26.4

Source: Company, Angel Research

EBITDA (%)

10.4

7.9

8.6

7.5

7.5

EPS (Rs)

7.7

8.0

19.8

35.9

45.4

P/E (x)

125.9

120.5

48.7

26.8

21.2

Nidhi Agrawal

P/BV (x)

11.6

9.1

3.4

3.1

2.7

+022 39357600, Extn: 6872

RoE (%)

9.2

7.5

7.0

11.4

12.9

RoCE (%)

14.1

13.3

13.5

15.7

17.2

EV/EBITDA

29.1

25.4

16.0

12.8

10.6

EV/Sales

3.0

2.0

1.4

1.0

0.8

Source: Angel Research; CMP calculated at the end of 20th June 2018

Please refer to important disclosures at the end of this report

1

Amber Enterprises | Initiating Coverage

Company background

The company was incorporated as Amber Enterprises India Private Limited on April

2, 1990 at Jalandhar, Punjab, as a private limited company under the Companies

Act, 1956. It was converted to a public limited company pursuant to a special

resolution passed by its shareholders on September 20, 2017. From a single

factory in Rajpura, Punjab, that commenced operations in 1994, it has grown to

12 manufacturing facilities across seven locations in India. Its manufacturing

facilities have a high degree of backward integration and are strategically located

in proximity to its customers’ facilities. It has also seen three rounds of private

capital infusion (IFCI Venture Capital Funds Limited, Reliance Alternative

Investments Fund - Private Equity Scheme-I through Fairwinds Trustees Services

Private Limited and ADV Opportunities Fund LLP through their investment entity

Ascent). In January 2018, it came out with an IPO.

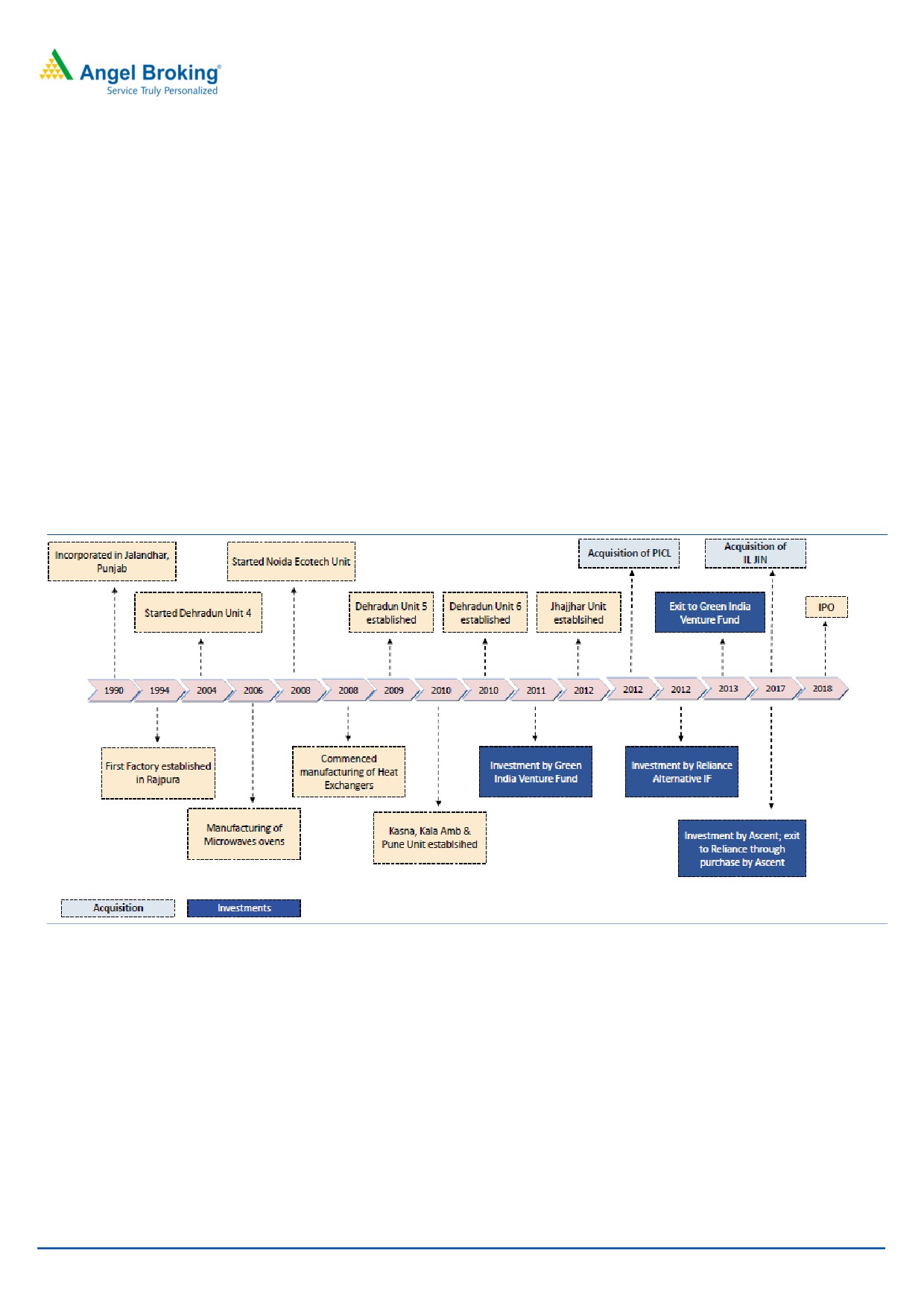

Exhibit 1: Company timeline

Source: Company, Angel Research

Product portfolio:

RAC: It designs and manufactures complete RAC including window air

conditioners (WAC), indoor units (IDU) and outdoor units (ODU) of split air

conditioners (SAC) with specifications ranging from 0.75 ton to 2 ton, across

energy ratings and types of refrigerants.

RAC Components: It manufactures critical and reliability functional

components of RACs such as heat exchangers, motors and multi-flow

condensers. It manufactures other RAC components such as sheet metal

components, copper tubing and injection molding components.

June 21, 2018

2

Amber Enterprises | Initiating Coverage

Other Components: It manufactures components for other consumer durables

and automobiles such as case liners for refrigerator, plastic extrusion sheets

for consumer durables and automobile industry, sheet metal components for

microwave, washing machine tub assemblies and for automobiles and metal

ceiling industries.

Exhibit 2: Revenue break-up

` Cr

FY14

FY15

FY16

FY17

FY18

CAGR

Air Conditioners

526

699

699

1252

1525

31%

Ac components

186

212

210

189

293

12%

Non AC components

262

319

179

210

310

4%

Total sales -` cr

973

1230

1089

1652

2128

22%

Total sales volume - '000

516

684

800

1514

1910

39%

Source: Company, Angel Research

Key Management Personnel

Jasbir Singh is the Chairman and Chief Executive Officer of the Company. He

holds a Bachelors degree in engineering (industrial production) from Karnataka

University and Masters degree in business administration from the University of

Hull, United Kingdom. He was appointed to the Board of the Company since

October 1, 2004. He has over 13 years of experience in the RAC manufacturing

sector. He has played an instrumental role in successful acquisition of PICL (India)

Private Limited in 2012.

Daljit Singh is the Managing Director of the Company. He holds a Bachelors

degree in electronic engineering from Nagpur University and Masters degree in

information technology from the Rochester Institute of Technology. He has received

‘Entrepreneur of the Year 2016’ award from Ludhiana Management Association.

He was appointed to the Board of the Company on January 1, 2008. Prior to

joining this Company, he was associated with Morgan Stanley in New York as an

analyst.

Manoj Kumar Sehrawat is a Nominee Director of the Company nominated by

Ascent and was appointed to the Board of Company in January 12, 2017. He has

20 years of experience in financial services. He is a managing director at ADV

Partners Management Pte. Limited (ADV), the manager to a sub fund of ADV

Opportunities Fund LLP, a Cayman Islands exempted limited partnership.

June 21, 2018

3

Amber Enterprises | Initiating Coverage

Investment Rationale

Favorable industry trends

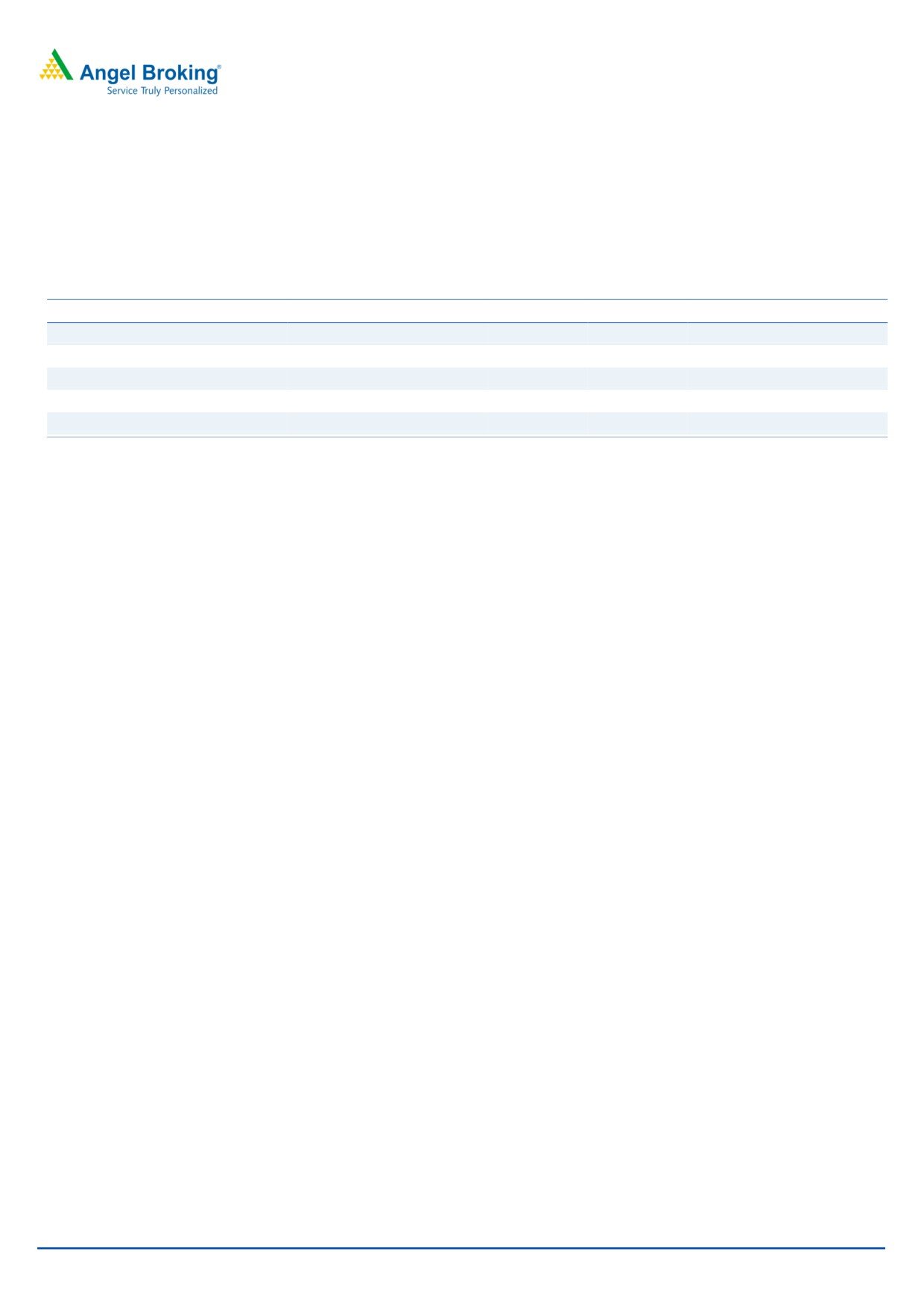

Amber is in a sweet spot, as the RAC industry is growing at 10%+CAGR. The

growth of this industry is driven by the increase in disposable income, humid

climate of India, urbanization and easy consumer financing. The RAC volumes are

expected to increase from 4.7 million units in FY2017 to reach 8.6 million units by

FY2022E.

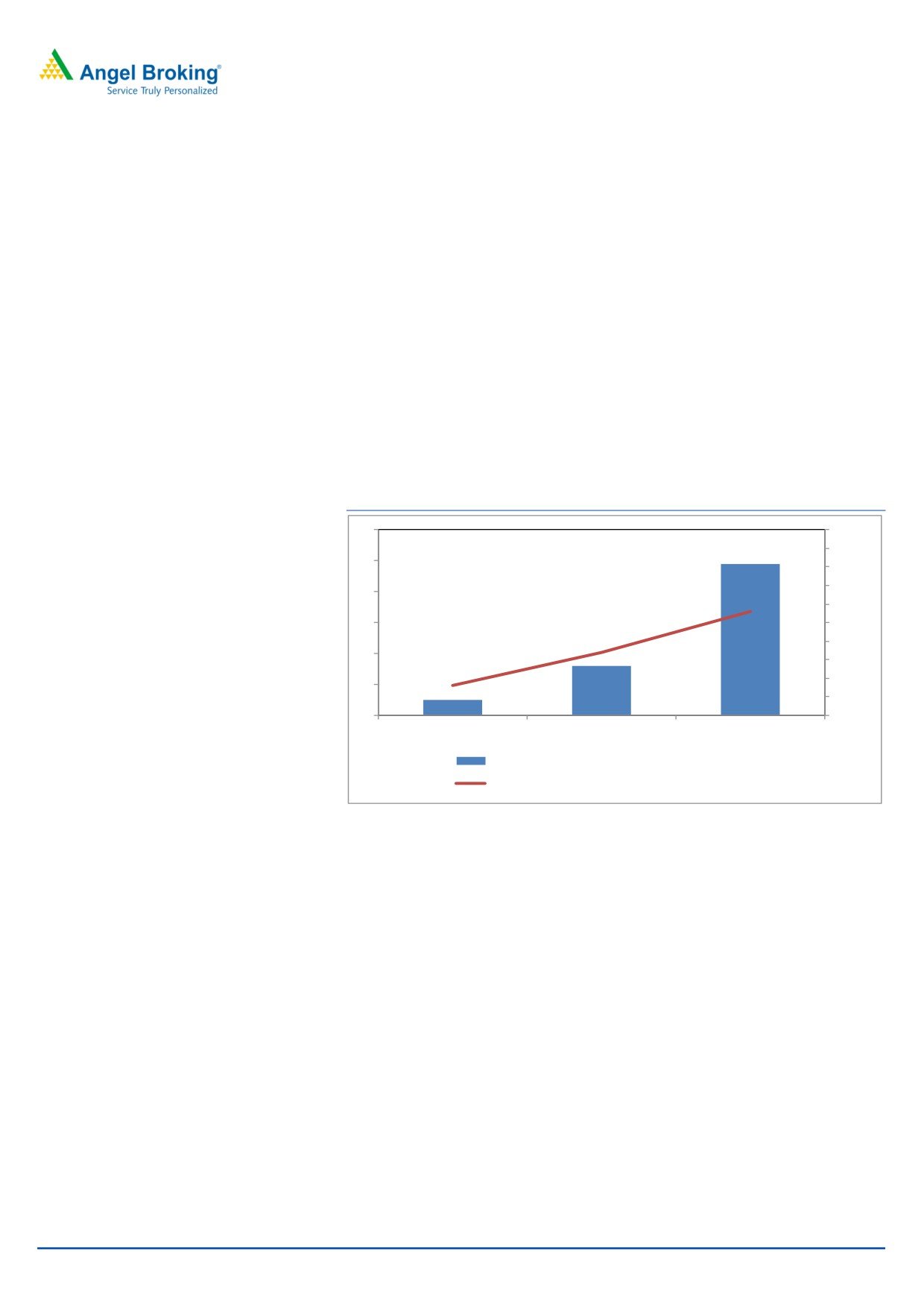

Exhibit 3: ACs volume growth to remain buoyant

Source: Company, Frost and Sullivan

Lower penetration in India provides huge opportunity

Due to the current low penetration of 4% versus (53% in China/ global average-

30%), the Indian RAC market presents huge opportunity for players to garner

larger share of the market. Viewed as a luxury product in the recent past, the

sweltering and longer summers in the country have led to creation of new demand

for RACs not only in the larger cities, but also in Tier II/III cities amid better

affordability.

Exhibit 4: RAC penetration level across countries

120%

100%

80%

60%

40%

20%

0%

Global

China

Japan

Malaysia

Thailand

India

Source: Industry , Angel Research

June 21, 2018

4

Amber Enterprises | Initiating Coverage

Preference for local OEM/ODMs in India

RAC brands have established manufacturing units in India to hedge against higher

cost of manufacturing in China. China has enjoyed an advantageous position in

low cost manufacturing however due to issues in supply chain management, such

as logistics costs, lead time, higher working capital, rising wages, etc., forced

manufacturers to explore alternative locations to maintain cost. Global RAC brands

now prefer India as the new manufacturing location for addressing the domestic

demand and also for limited exports.

OEM/ODM share to rise

In the RAC industry, the share of OEM/ODM is expected to grow by 25% CAGR to

reach 56% of the RAC market by 2022 (from current 34%). These factors favor

Amber owing to its focus on ODM. Further, the product approval cycle goes

beyond 2-3 years creating a moat for Amber to keep the competition under check.

Exhibit 5: Rising share of OEM/ODM

100%

6

90%

5

80%

70%

4

60%

3

50%

40%

2

30%

20%

1

10%

0

0%

FY12

FY17

FY22E

ODM/ OEM volume (Mn) (LHS)

Conribution as % of total RAC volume (RHS)

Market leadership driven by integration and R&D

Amber commands 19% market share in Indian RAC manufacturing through its 12

manufacturing facilities strategically located across India. In a short span of nine

years, it has evolved from being original equipment manufacturing (OEM) to high-

margin Original Design Manufacturing (ODM) in RACs mainly led by high degree

of backward integration and strong R&D capabilities. The company has been

plugging via inorganic acquisitions like PICL for its fractional horse power motors

capabilities in 2012 and 2 companies in FY2018.

June 21, 2018

5

Amber Enterprises | Initiating Coverage

Exhibit 6: High degree of Backward Integration

Source: Company

Exhibit 7: Growing share of OEM/ ODM in RAC manufacturing: Amber commands 55% in outsourced one

81%

85%

Others

45%

Amber

55%

19%

15%

FY15

FY17

Amber Others

Source: Company, Frost and Sullivan

Exports could also flourish

Amber has posted revenue CAGR of 19% over FY13-18 mainly led by domestic market. Now, with its proven track record and

manufacturing capabilities, the company is now exploring export opportunities to UAE, Oman, SriLanka, Nigeria & South Africa.

The company is looking to increase exports to form 5-7% of revenue by FY2021-22.

June 21, 2018

6

Amber Enterprises | Initiating Coverage

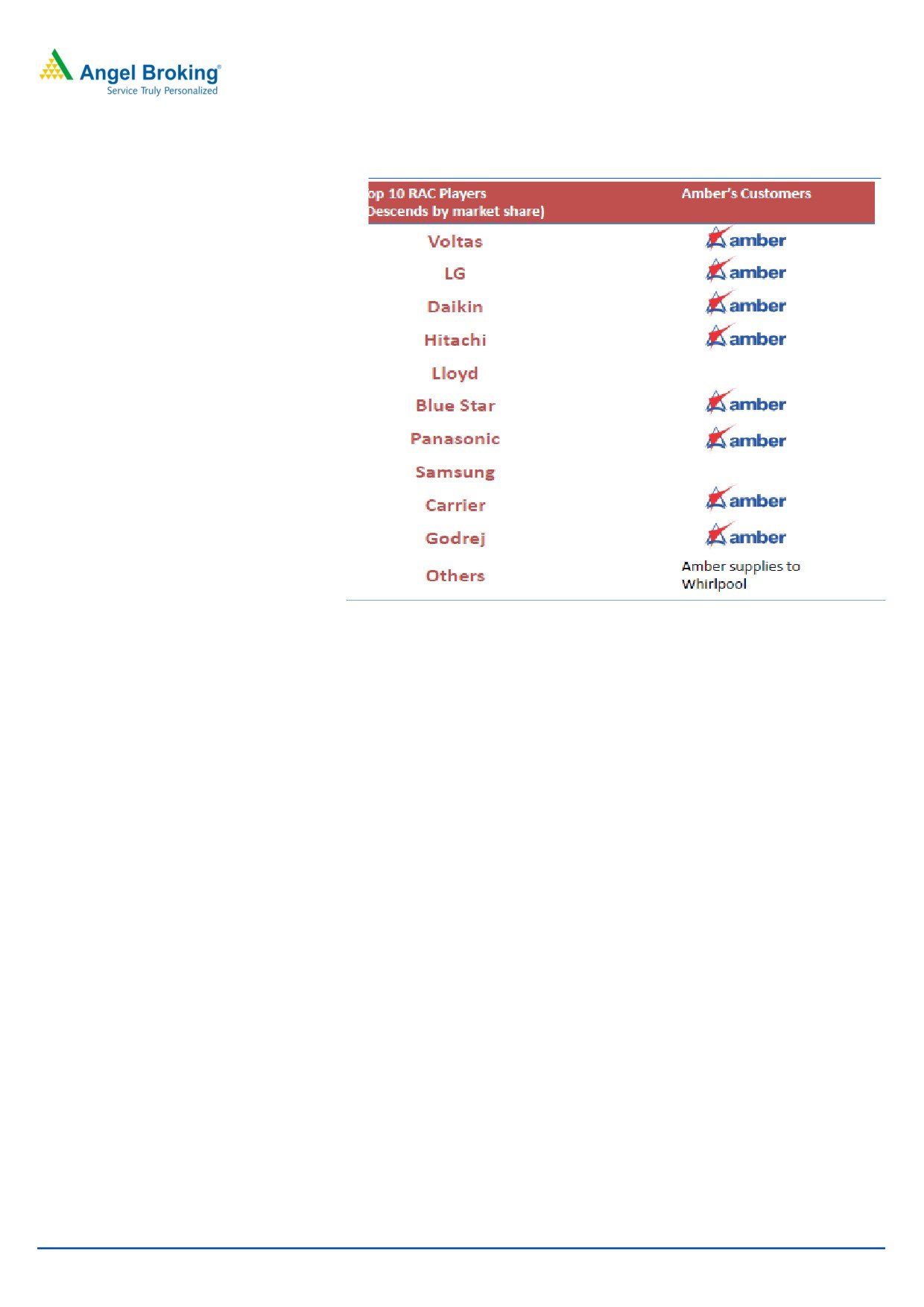

Exhibit 8: Amber supplies to over 75% of the ACs market

Source: Company, Angel Research

Recent Acquisitions to further boost its manufacturing capabilities

In line with its strategy to capture more wallet share and increase offerings in

inverter RACs and consumer appliances like Microwave and Refrigerator, it has

made 2 acquisitions in the printed circuit board (PCB) manufacturing space over

the last 1 year; IL JIN Electronics and Ever Electronics. PCB forms a critical part of

inverter ACs.

IL JIN

IL JIN Electronics was acquired for `54 cr for 70% stake before the IPO and is one

of the largest PCB manufacturing companies in the space of air conditioners and

white goods category. In FY2018, ‘IL JIN’ contributed Rs 100 crore to Amber’s

consolidated operating revenue (accounting sales for 3 month only) with a

operating margin of 3.5-4%. The company expects to improve its margins by at

least 100bps by FY2020.

Ever Electronics

Ever Electronics (EVER) is one of the leading electronic PCB manufacturers in India.

LG, LS Automotive, Powercraft Electronics, Godrej and Intangibles Labs are among

its major clients. After acquiring its 19 % stake in Q4FY2018 for `5.6 cr, Amber is

scheduled to acquire an additional 51% stake in the company by FY2019 for

`15.5 cr. EVER has posted a revenue of `225 cr in FY2018 and likely to grow by

15-20% in FY2019. Margins are low at 3-3.5% which are expected to improve by

operational synergies on merger.

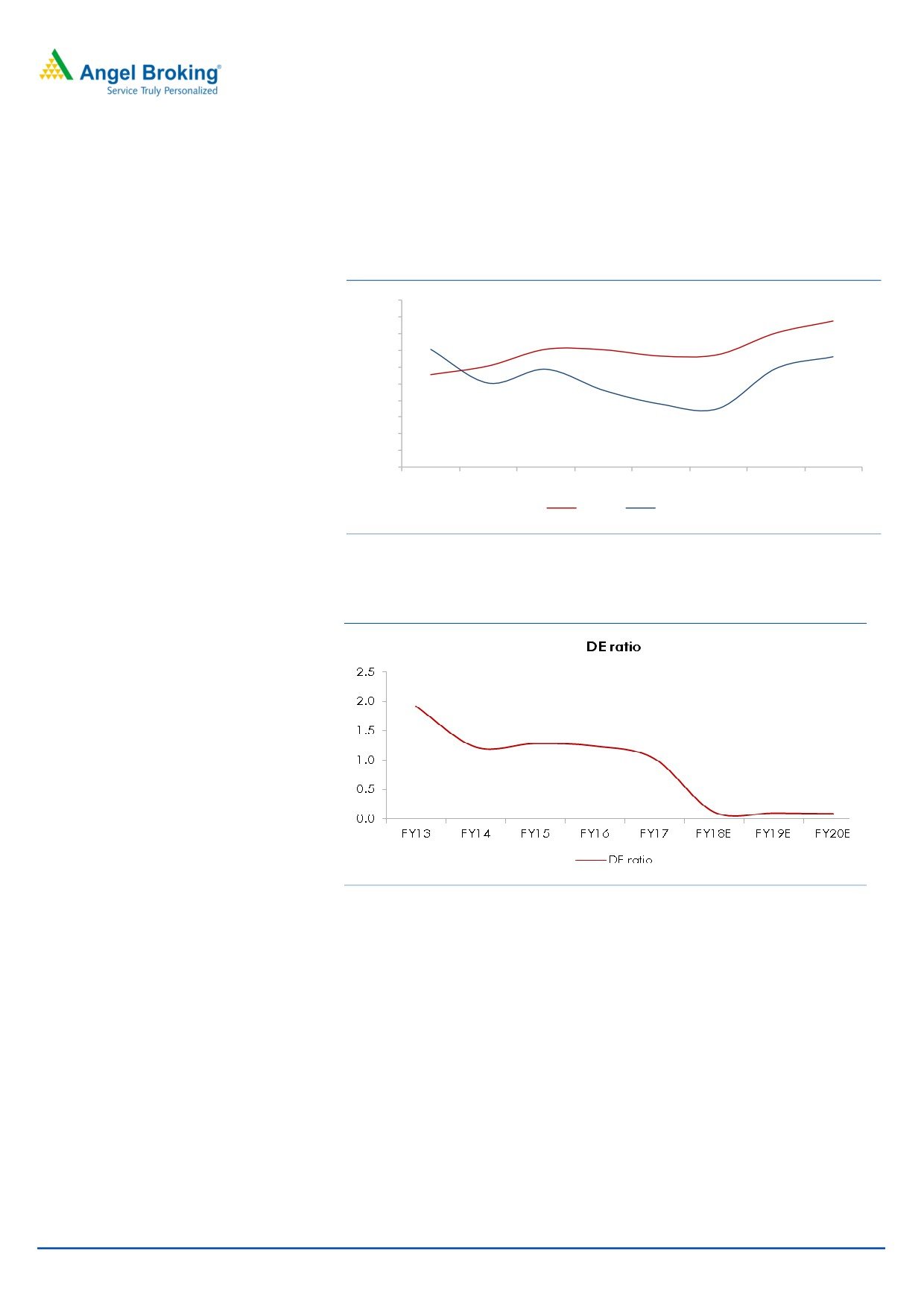

Strong boost in profits and debt reduction

The company improved its margins to 8.6% in FY2018 led by higher capacity

utilization amid robust RACs’ demand. Due to recent acquisitions ( expected to

form ~20-22% of revenue in FY2019) which have lower margins, overall margins

June 21, 2018

7

Amber Enterprises | Initiating Coverage

may not expand in near term, but operating profits will see good jump on an

absolute basis. It currently has small working capital debt only post IPO which will

substantially reduce its interest cost in FY2019. The company is not planning to

undertake any major capex in the next 2-3 years. Its maintenance capex of `40

crore could be easily funded via internal accruals.

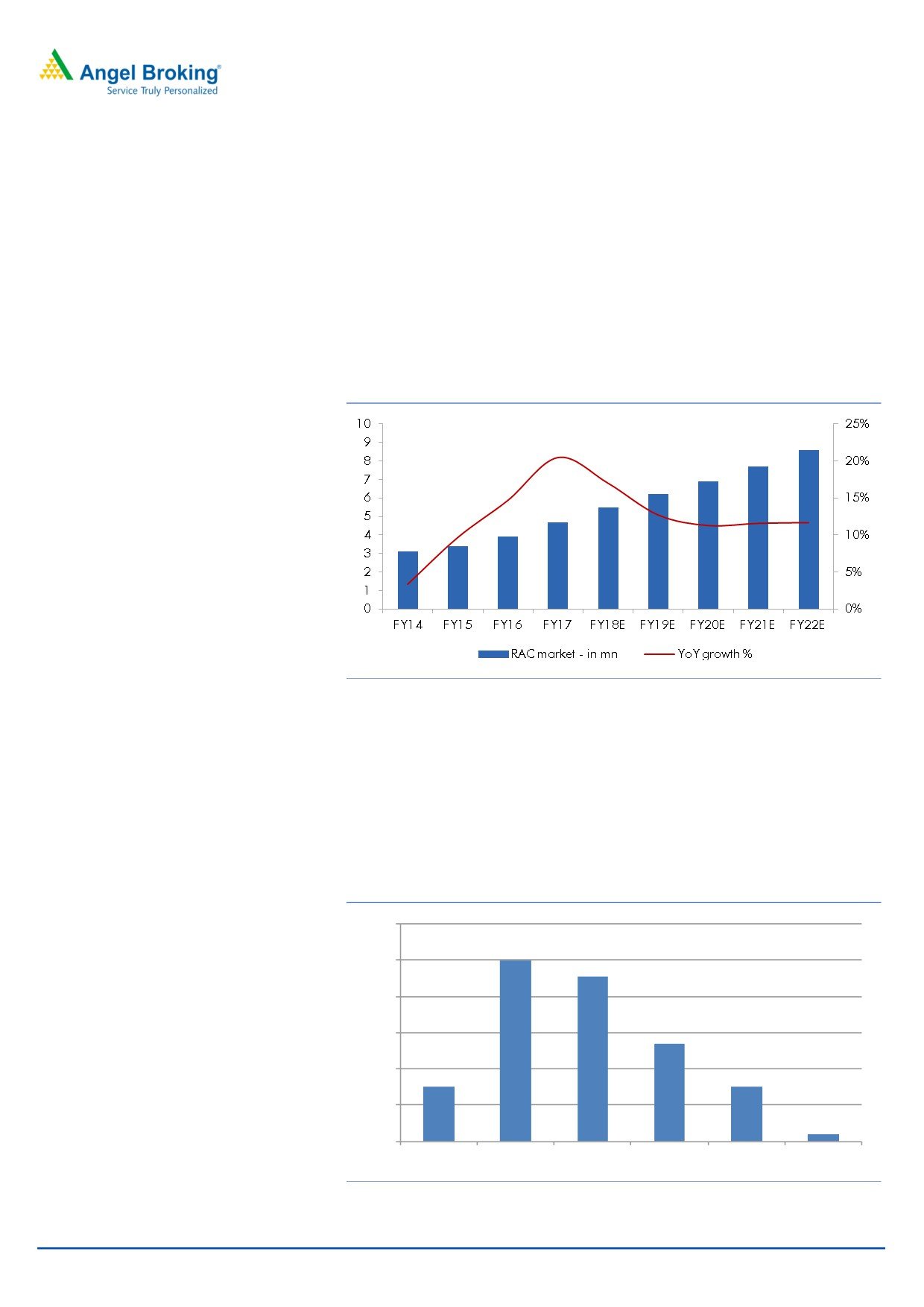

Exhibit 9: Returns ratio to improve with better utilization

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

FY13

FY14

FY15

FY16

FY17

FY18E FY19E FY20E

ROCE

ROE

Source: Company, Angel Research

Exhibit 10: DE ratio went down post IPO

Source: Company, Angel Research

June 21, 2018

8

Amber Enterprises | Initiating Coverage

Outlook

Amber has reported a CAGR of 19%/ 27% in revenue/ PAT over FY2013-18 led by

rising volume and improving margins. We expect it to report net revenue/PAT

CAGR of 28%/51% respectively over FY2018-20E. Revenue will increase by 39%

yoy in FY2019, mainly due to consolidation of its recent 2 acquisitions and a

~12% growth in standalone business. In FY2020, the revenue is estimated to

increase by 18% yoy. Due to recent acquisitions ( expected to form ~20-22% of

revenue in FY2019) which have lower margins, overall margins may not expand in

near term, but operating profits will see good jump on an absolute basis. We are

estimating a PAT margin of 4%, up from past level of 2-3%.

Valuation

Post the recent correction, Amber is currently trading at 21x FY2020 earnings

which is at ~25-30%+ discount than its closest peer - Dixon Technologies. The

stock has been trading at an average of 32 forward PE in its brief trading history

post IPO in January 2018. The recent correction has provided a very good entry

point for the investors to take a bet on the booming AC space. Hence, we initiate

coverage on the stock with a BUY recommendation and Target Price of `1272

(28x FY2020E EPS), an upside of 32% from the current levels.

Exhibit 10: Peer valuation

Dixon Technologies

Amber Enterprises

` Cr

FY2018

FY2019E

FY2020E

FY2018

FY2019E

FY2020E

Revenue

2,904.5

3,590.6

4,265.9

2,128.1

2,957.5

3,489.8

Operating Profit

99.8

141.4

183.3

183.5

221.8

261.7

OPM %

3.4%

3.9%

4.3%

8.6%

7.5%

7.5%

Pre-Tax Profit

91.6

135.5

176.0

89.4

162.2

205.0

Net Income Adj

63.4

93.3

121.2

62.3

113.0

142.9

EPS, Adj+

56.2

82.4

107.0

19.8

35.9

45.4

P/E

52.2

35.6

27.4

48.7

26.8

21.2

Return on Equity( %)

23.7

25.7

26.8

7.0

11.4

12.9

Source: Angel Research, Bloomberg

Key risks

Client concentration

Amber’s business is dependent on certain principal customers and the loss of or a

significant reduction in their purchases could adversely affect its business. Its top

five and 10 customers contributed 74.8% and 92.5% respectively to sales in FY17.

Adverse trend in OEM/ODM

In recent years, RAC brands have increasingly outsourced the manufacturing of

their products to OEM/ODM players like Amber. However, there can be no

assurance that they will continue to do so in the future.

Changing preferences, advancement in technology

The markets in which company’s customers compete are characterized by

consumers and their rapidly changing preferences, advancement in technology

and other related factors including lower manufacturing costs. Hence, the

company may be affected by any disruptions in the industry.

June 21, 2018

9

Amber Enterprises | Initiating Coverage

Consolidated Income Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E FY2020E

Total operating income

1,089.0

1,651.9

2,128.1

2,957.5

3,489.8

% chg

-11.5

51.7

28.8

39.0

18.0

Total Expenditure

975.3

1,521.3

1,944.5

2,735.7

3,228.1

Raw Material

858.5

1,371.2

1,768.8

2,513.9

2,966.4

Personnel

36.5

43.7

49.8

59.1

69.8

Others Expenses

80.3

106.5

125.9

162.7

191.9

EBITDA

113.7

130.5

183.5

221.8

261.7

% chg

10.9

14.8

40.6

20.9

18.0

(% of Net Sales)

10.4

7.9

8.6

7.5

7.5

Depreciation& Amortisation

30.9

40.1

49.0

51.2

54.3

EBIT

82.9

90.4

134.5

170.6

207.5

% chg

7.6

9.1

48.8

26.8

21.6

(% of Net Sales)

7.6

5.5

6.3

5.8

5.9

Interest & other Charges

53.2

63.5

53.8

18.8

15.0

Other Income

3.1

8.8

8.7

10.5

12.6

(% of Sales)

0.3

0.5

0.4

0.4

0.4

Extraordinary Items

-

-

-

-

-

Share in profit of Associates

-

-

-

-

-

Recurring PBT

32.7

35.7

89.4

162.2

205.0

% chg

-19.0

9.2

150.4

81.4

26.4

Tax

8.6

10.5

27.1

49.2

62.1

PAT (reported)

24.1

25.2

62.3

113.0

142.9

% chg

-13.5

4.5

147.4

81.4

26.4

(% of Net Sales)

2.2

1.5

2.9

3.8

4.1

Basic & Fully Diluted EPS (Rs)

7.7

8.0

19.8

35.9

45.4

% chg

-13.5

4.5

147.4

81.4

26.4

Source: Company, Angel Research

June 21, 2018

10

Amber Enterprises | Initiating Coverage

Consolidated Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

21.7

23.8

31.4

31.4

31.4

Reserves& Surplus

240.9

311.1

861.3

956.7

1,077.2

Shareholders’ Funds

262.6

334.9

892.8

988.1

1,108.6

Minority Interest

-

-

-

-

-

Total Loans

326.6

344.9

105.5

100.0

100.0

Other Liab & Prov

80.8

46.8

64.4

89.5

105.7

Total Liabilities

670.0

726.6

1,062.7

1,177.7

1,314.3

APPLICATION OF FUNDS

Net Block

536.1

577.5

739.8

789.8

839.8

Capital Work-in-Progress

2.0

3.0

4.0

5.0

6.0

Investments

-

-

5.7

55.7

105.7

Current Assets

533.6

650.4

964.0

1,237.0

1,438.6

Inventories

225.8

267.7

395.6

486.2

573.7

Sundry Debtors

247.9

310.4

378.6

486.2

573.7

Cash

18.4

34.7

133.8

172.4

181.6

Loans & Advances

40.6

37.1

28.3

59.1

69.8

Other Assets

1.0

0.5

27.6

33.1

39.8

Current liabilities

445.0

560.0

665.8

925.3

1,091.9

Net Current Assets

88.6

90.4

298.2

311.7

346.7

Other Non Current Asset

45.3

58.6

19.1

20.5

22.2

Total Assets

670.0

726.6

1062.7

1177.6

1314.3

Source: Company, Angel Research

June 21, 2018

11

Amber Enterprises | Initiating Coverage

Consolidated Cash Flow Statement

Y/E March (`cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

Profit before tax

32.7

38.4

89.4

162.2

205.0

Depreciation

30.9

39.7

49.0

51.2

54.3

Change in Working Capital

42.9

(23.3)

(67.7)

(37.8)

(84.7)

Interest / Dividend (Net)

-

-

-

-

-

Direct taxes paid

(10.5)

(9.0)

(27.1)

(49.2)

(62.1)

Others

(56.2)

(52.7)

(38.8)

(5.4)

15.8

Cash Flow from Operations

152.2

98.5

82.4

131.9

96.6

(Inc.)/ Dec. in Fixed Assets

(101.2)

(82.0)

(162.2)

(50.0)

(50.0)

(Inc.)/ Dec. in Investments

1.4

0.8

-

-

-

Cash Flow from Investing

(83.9)

(89.7)

(162.2)

(50.0)

(50.0)

Issue of Equity

-

50.0

505.3

-

-

Inc./(Dec.) in loans

150.6

46.4

(239.4)

(5.5)

-

Others

218.5

97.6

63.6

36.5

37.4

Cash Flow from Financing

(67.9)

(1.2)

202.3

(42.0)

(37.4)

Inc./(Dec.) in Cash

0.4

7.6

122.5

39.8

9.3

Opening Cash balances

2.0

2.4

10.0

132.5

172.4

Closing Cash balances

2.4

10.0

132.5

172.4

181.6

Source: Company, Angel Research

Key Ratios

Y/E March

FY2016

FY2017

FY2018

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

125.9

120.5

48.7

26.8

21.2

P/CEPS

28.5

25.4

12.4

7.5

6.0

P/BV

11.6

9.1

3.4

3.1

2.7

Dividend yield (%)

-

-

-

-

EV/Sales

3.0

2.0

1.4

1.0

0.8

EV/EBITDA

29.1

25.4

16.0

12.8

10.6

EV / Total Assets

4.9

4.6

2.8

2.4

2.1

Per Share Data (`)

EPS (fully diluted)

7.7

8.0

19.8

35.9

45.4

Cash EPS

33.9

37.9

77.9

129.3

160.1

Book Value

83.5

106.5

283.9

314.2

352.5

Returns (%)

ROCE

14.1

13.3

13.5

15.7

17.2

Angel ROIC (Pre-tax)

13.7

13.9

15.9

19.5

21.8

ROE

9.2

7.5

7.0

11.4

12.9

Turnover ratios (x)

Asset Turnover (Gross Block)

2.3

2.9

3.8

4.8

5.3

Inventory / Sales (days)

76

59

68

60

60

Receivables (days)

83

69

65

60

60

Payables (days)

95

99

98

98

98

Working capital cycle (ex-cash) (days)

64

29

35

22

22

Source: Company, Angel Research

June 21, 2018

12

Amber Enterprises | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Amber Enterprises India Ltd.

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

June 21, 2018

13